Mastering the Digital Nomad Visa: Your Ultimate Guide to Unlocking Spain’s Remote Work Paradise

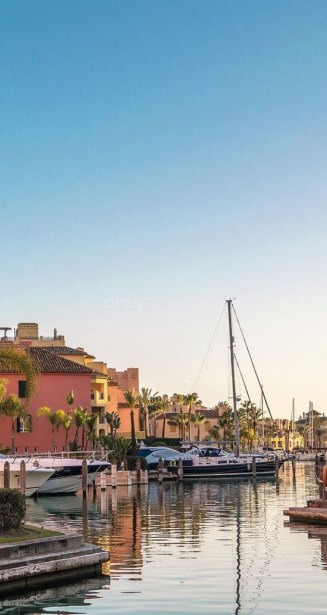

In an era shifting towards a remote-centric work lifestyle, many individuals are seizing the opportunity to work from abroad, opening avenues for exploration and cultural experiences. Choosing where to live and work has become a powerful tool, making the introduction of a digital nomad visa for Spain a thrilling prospect.

WHAT IS A SPANISH DIGITAL NOMAD VISA?

A Spanish digital nomad visa acts as a residence permit, allowing non-European citizens to live and work remotely in Spain for up to 5 years. This extends to the applicant’s spouse and children, making it an attractive option for those working remotely for foreign companies. Spain, with its favorable visa policies, has become a top destination for digital nomads seeking a balance between work and travel.

REQUIREMENTS FOR OBTAINING A SPANISH DIGITAL NOMAD VISA:

Before applying, individuals must meet one of the following criteria:

- Employed by a company allowing international remote work.

- Self-employed with multiple international clients or generating income from online activities outside Spain.

Specifics differ:

For employees:

- The foreign company must have a 1-year working history and endorse remote work.

- Proof of a working relationship for at least 3 months.

- Sufficient work experience (minimum 3 years) or a degree from a reputable institution.

- Clean criminal record.

- Adequate private health insurance in Spain.

For freelancers:

- Work for at least one foreign client outside Spain.

- Specifics for working remotely.

- 3-month work history with clients.

- Clean criminal record.

- Adequate private health insurance in Spain.

- Proof of funds or a salary contract.

HOW TO APPLY FOR A SPANISH DIGITAL NOMAD VISA:

Options include applying from the country of origin for a 1-year visa convertible to residency, applying as a tourist in Spain for a 3-year visa (renewable for 2 years), or applying within the first 30 days of arrival.

WORKING IN SPAIN WITH A DIGITAL NOMAD VISA:

Non-EU citizens can work in Spain, with a cap of 20% income from Spanish sources. A continuing relationship with the foreign employer supporting remote work is required.

TAX BENEFITS OF THE SPANISH DIGITAL NOMAD VISA:

Beyond accessibility, tax benefits make the visa attractive. Non-resident income tax regime offers a flat 24% rate on income up to €600,000 for the first 5 years, with exemptions from wealth tax and Model 720 declaration. The favorable tax regime continues for 5 years under digital nomad residency, followed by a transition to the standard tax regime.

BENEFITS FOR SPAIN’S ECONOMY:

A digital nomad visa can positively impact the Spanish economy through increased tourism, real estate market growth, attraction of skilled workers, foreign investments, and enhancement of overall quality of life.

ALTERNATIVES TO THE SPANISH DIGITAL NOMAD VISA:

Other visa options include the Spain Entrepreneur Visa for innovative business projects, the Spain Working Holiday Visa for temporary work experiences, and the Spain Au Pair Visa for students living with Spanish families during their studies. Each option caters to different needs and circumstances.

In conclusion, the Spanish digital nomad visa not only aligns with the evolving work landscape but also contributes significantly to Spain’s economic growth and cultural vibrancy.