Buying Property in Sotogrande, Spain: Step-by-Step Process for Investors and Homebuyers

For some, buying a property may seem as easy as saying, “I want to buy a house.” However, based on our experience, it’s not as straightforward as finding a property you like and making a purchase. We’ve put together a guide to help those interested in buying property in Sotogrande ensure a smooth process.

DO YOUR RESEARCH WHEN PLANNING TO BUYING PROPERTY IN SOTOGRANDE

When it comes to making a significant financial commitment like purchasing a property, thorough research and preparation are essential for a successful start. Particularly, when looking for properties in the Sotogrande area, your initial research should focus on finding the right real estate agent.

This is where the Internet plays a crucial role. The internet has become an indispensable tool for individuals, making it easier for those living abroad but interested in acquiring a property or relocating to the Sotogrande region. It allows you to explore available properties in advance.

In terms of the property market in Sotogrande , it operates openly, meaning that most real estate companies have access to the same pool of properties for sale, largely due to a shared database. Sotogrande boasts numerous real estate companies and agents, providing you with a wide range of options when searching for the right agent.

During your search for a real estate firm or agent, it’s wise to keep an open mind. You don’t have to commit to a single agent right away; you can initially engage with several agents. While this approach gives you a diverse selection, ultimately, it’s crucial to narrow down your choices to one. Trust is paramount in this process, and you should have confidence that your chosen agent will represent your interests effectively.

We recommend starting your research by identifying a selection of firms or agents that resonate with you. However, it’s vital to eventually choose one with whom you feel the most comfortable. This decision hinges on your ability to place your trust in their hands, confident that they will advocate for your preferences. This is why Open Frontiers takes pride in its real estate services, as all our agents are highly knowledgeable and experienced, ensuring you can place your trust in their expertise.

IS SOTOGRANDE A NICE PLACE TO LIVE?

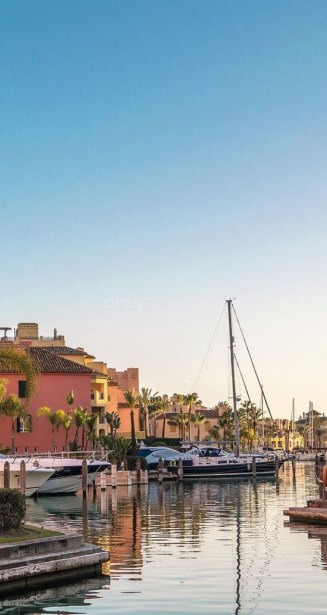

Sotogrande is a captivating gem on Spain’s southern coast, offering an idyllic blend of luxury living and natural beauty. Its pristine Mediterranean beaches, lush green landscapes, and a Mediterranean climate that graces residents with sunshine year-round make it an exquisite haven for those who relish the great outdoors. The area’s world-class golf courses, yacht-filled marina, and equestrian facilities cater to a sophisticated and active lifestyle. With an international community that fosters diversity, accessibility to nearby cities, and a harmonious blend of modernity and tradition, Sotogrande stands out as a highly desirable place to call home, offering an exceptional quality of life in a stunning Mediterranean setting.

IS SOTOGRANDE EXPENSIVE TO BUYING PROPERTY?

Similarly, Sotogrande is renowned for its status as an exclusive destination, often associated with the affluent. This reputation is reflected in the property market, where you’ll find a range of luxurious options. Waterfront estates, upscale villas, and high-end developments are prevalent, often reaching into the multimillion-dollar range. Notable individuals like celebrities and business leaders have been drawn to Sotogrande’s allure. However, it’s important to note that Sotogrande also offers diverse housing options in terms of price. While areas like La Reserva and Kings and Queens surpass the top tier in terms of pricing, other neighborhoods offer more affordable housing choices, making Sotogrande accessible to a broader range of prospective residents.

WHY SHOULD I USE A REAL ESTATE AGENT?

In today’s age of constant online information, some may assume that they can easily handle property research and transactions on their own, bypassing the need for a real estate agent. However, this perception overlooks the invaluable roles that real estate agents play.

Firstly, agents take the burden of exhaustive property searching off your shoulders, streamlining your home search and presenting you with the most relevant options.

Secondly, they possess a keen eye for detail. Even if you’re enamored with a property, an agent can identify potential issues and nuances that might escape your notice, preventing future regrets.

Furthermore, real estate agents can discern the investment potential of a property, helping you make informed decisions that align with your financial goals.

Your agent also doubles as a local expert, providing you with essential insights about the area, including schools, amenities, and community dynamics.

Moreover, they leverage their extensive network to save you precious time by connecting you with trusted service providers, contractors, and other essential resources.

Most crucially, a skilled agent is a master negotiator. Throughout the negotiation process, they tirelessly advocate for your best interests, ensuring you secure the most favorable deal possible and protecting your investment. In essence, a real estate agent’s expertise and dedication are indispensable assets in the complex world of real estate transactions.

TRAVEL TO SOTOGRANDE AND ORGANIZE YOUR PROPERTY VIEWINGS

Now that you’ve made preparations, it’s time to arrange your trip to Sotogrande and coordinate your property viewings. Whether you’re planning from a distance or already in Sotogrande, here’s how to effectively organize your property tours:

- Tip 1: Advance Planning: We strongly recommend having a selection of preferred properties in mind before your visit.

- Tip 2: Partner with Your Chosen Agent: By this stage, you should have chosen your real estate firm and agent. Allow your agent to schedule multiple viewings throughout a single day, optimizing your time and providing a comprehensive market overview.

- Tip 3: Manageable Viewing Load: We recommend viewing around five properties in a day to prevent overwhelming yourself and maintaining a clear perspective. However, if your visit is short, consider extending your viewing list to around 10 properties on your designated tour day.

- Tip 4: Explore the Surroundings: Remember that it’s not only the property itself but also its location that matters. Consider your preferences, such as gated communities, proximity to the beach, accessibility to schools, noise levels, etc. Take a drive around the area to familiarize yourself with the neighborhood.

- Tip 5: Nighttime Assessment: If you’re interested in a property during the daytime viewing, consider revisiting it at night. Properties can have a different ambiance after dark, potentially altering your perception.

- Tip 6: Open Communication: Don’t hesitate to express your opinions about the properties you’re viewing. If you like a property, voice it; if not, communicate that as well. This feedback helps you make informed decisions and allows your agent to adapt and recommend properties that align with your requirements. Trust in your agent’s adaptability, and maintain an open dialogue. Keeping your agent informed about your preferences helps them understand your needs better.

- Tip 7: Flexibility in Plans: Be prepared for viewings to be adjusted because your preferences may change during the process. A property that seemed ideal online may differ in person. This underscores the importance of selecting your agent carefully. A skilled real estate agent will promptly adjust schedules and viewing options to find the best solution for you based on your evolving preferences.

INITIAL VERIFACTION STEPS

1. Verifying Ownership

- Importance: This step is critical to ensure that the property is legally owned by the seller and to avoid any fraudulent transactions.

- How-to: This can be done by checking the property’s title deed, which is registered at the local land registry.

2. Compliance with Urban Planning Regulations

- Significance: Ensuring the property meets local planning laws is essential to avoid future legal issues, such as unapproved structures.

- Process: Consult the local town hall or a legal expert to verify that the property complies with zoning laws and has the necessary building permits.

3. Checking for Charges or Debts

- Why it Matters: Unresolved debts or liens can transfer to the new owner, leading to unexpected financial burdens.

- Method: Review the property’s records at the land registry and ensure that all taxes and community charges are up to date.

THE TRANSACTION PROCESS

1. Signing a Private Purchase and Sale Contract

- Details: This preliminary contract outlines the terms of the sale, including the price, payment schedule, and any conditions.

- Tip: It’s advisable to have a lawyer review this contract to ensure your interests are protected.

2. Signing the Public Deed of Sale

- Explanation: This is the formal agreement executed in the presence of a notary, legally transferring ownership.

- Variations: The timeline for signing can vary, and if the buyer is not present, a legal representative must be appointed.

3. Key Handover

- What to Expect: This marks the official transfer of possession to the buyer.

- Additional Info: Ensure a thorough inspection of the property is done before this stage.

4. Property Registry

- Process: The deed is then registered with the local land registry, legally recording the buyer as the new owner.

- Duration: While the full process takes time, a provisional registration is made immediately to secure the buyer’s rights.

DOCUMENTATION REQUIRED FOR BUYERS

1.Compliance with Anti-Money Laundering Laws

- Necessary Documents: Detailed list including notarized passport, KYC form, income tax return, bank statement, and proof of funds origin.

- Explanation: Each document serves to verify the identity and financial background of the buyer, ensuring transparency and legal compliance.

2.Obtaining the NIE (Número de Identificación de Extranjero)

- Importance: This identification number is mandatory for foreign buyers in Spain and is used for all transactions and tax purposes.

- Application Process: Detail the process of applying for an NIE, which can be done through Spanish consulates abroad or local police stations in Spain.